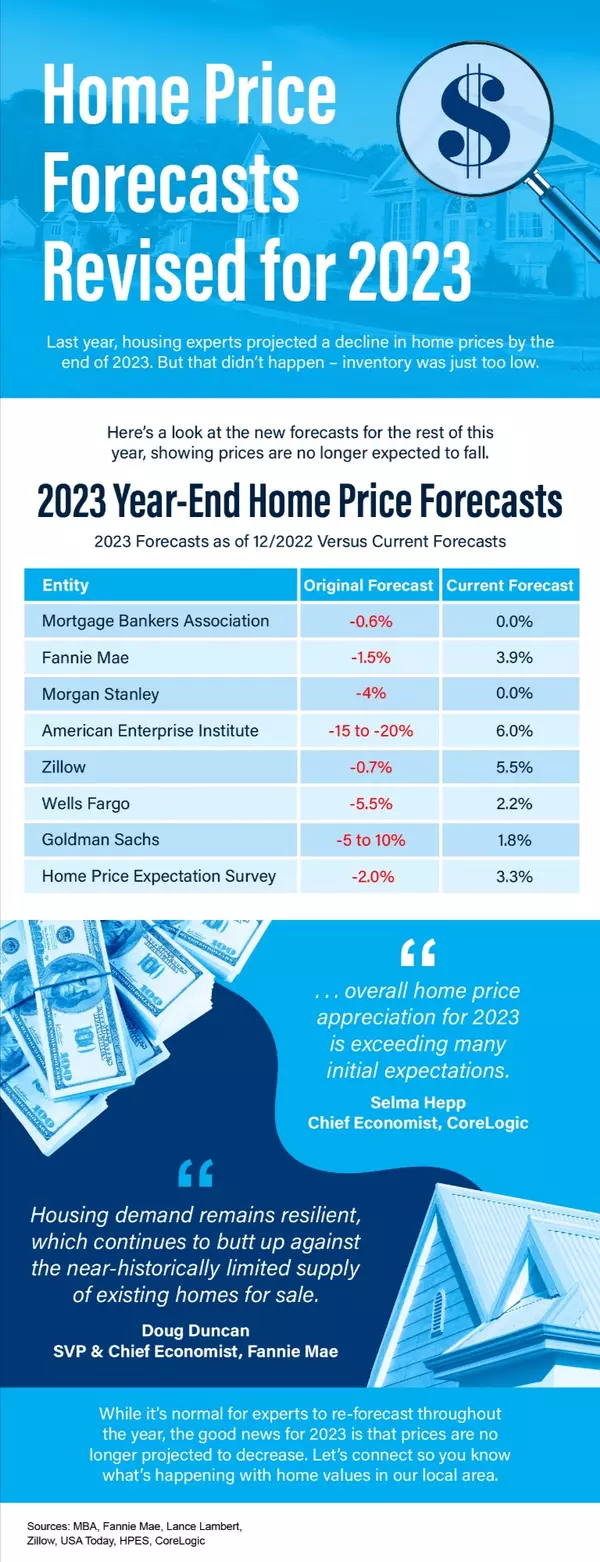

Home Prices Forecast Revised for 2023

Beginning with Pre-Approval

If you’re looking to buy a home this fall, there are a few things you need to know. Affordability is tight with today’s mortgage rates and rising home prices. At the same time, there’s a limited number of homes on the market right now and that’s creating some competition among buyers. But, if you’r

The Many Non-Financial Benefits of Homeownership

Buying and owning your own home can have a big impact on your life. While there are financial reasons to become a homeowner, it's essential to think about the non-financial benefits that make a home more than just a place to live. Here are some of the top non-financial reasons to buy a home. Acco

Categories

Recent Posts

Now’s the Time To Upgrade to Your Dream Home

Your Dream Home Awaits: Discover 7221 WINNIPEG CT, Gainesville, VA 20155

Home Values Rise Even as Median Prices Fall

Is Your House Priced Too High?

Falling Mortgage Rates Are Bringing Buyers Back

The Real Story Behind What’s Happening with Home Prices

Are We Heading into a Balanced Market?

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

The Great Wealth Transfer: A New Era of Opportunity

Helpful Negotiation Tactics for Today’s Housing Market