Growing Your Net Worth with Homeownership

Take a moment to imagine where you want to be in a few years. You might be thinking about your job, money, wanting more stability, or goals you want to reach soon. Is homeownership a part of that vision? If it is, you should know owning a home has a whole lot of financial benefits. One of the many

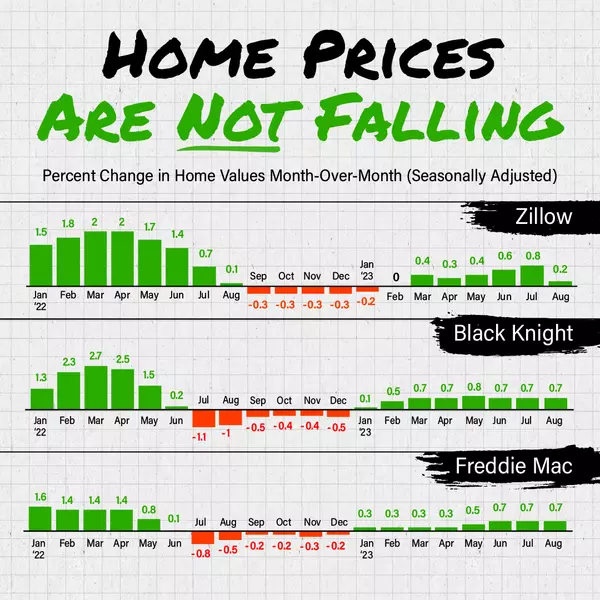

Home Prices are Not Falling!

No matter what you’re hearing in the news, data from multiple sources shows home prices are not falling. So, if you've been hesitant to make a move because you were worried about a potential price crash, know that prices are back on the rise nationally. Have questions about what’s happening near us

The Latest Expert Forecasts for Home Prices in 2023

Are you thinking about making a move? If so, all the speculation that home prices would crash this year may have you feeling a bit on edge about your decision. Let the data and the experts reassure you. Prices aren’t in a downward spiral and will actually finish the year strong. Even though you ma

Categories

Recent Posts